puerto rico tax incentives act 20

And promote the development of new businesses in Puerto Rico. Make Puerto Rico Your New Home.

Gov T Revokes 121 Tax Incentives Decrees Under Act 22 News Is My Business

Many high-net worth Taxpayers are understandably upset about the massive US.

. Get to know about Puerto Rico Tax Act 20 and Tax Act 22 to minimize your tax liability. On July 1 2019 Puerto Rico enacted legislation providing tax incentives for US. Act 20 Act 22 EB5 Discover Puerto Ricos Advantageous Tax Incentives.

With an ever-growing array of services. On January 17 2012 Puerto Rico enacted Act No. In addition to Act 20 Puerto Rico also passed Act 22 known as the Individual Investors Act so as to attract wealthy individual investors to relocate to the Island.

In 2008 a new Economic Incentives Act for the Development of Puerto Rico herein after Act 73 or Economic Incentives Act went into effect. Of particular interest are Chapter 2 of Act 60 for. Puerto Rico Incentives Code Act.

Taxes levied on their employment investment. On January 17 2012 Puerto Rico enacted Act No. Roberto is the Managing Partner at Omnia Economic Solutions an econ.

If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent. In June 2019 Puerto Rico made substantial changes to its tax incentives that came into effect on January 1 2020. Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS.

Few places on earth offer a return on investment the way Puerto Rico does. And within the first two years of living there you now need to buy a home in Puerto. Puerto Ricos Act 20 also seeks to encourage local service providers to expand their services to persons outside Puerto Rico.

In order to promote the necessary conditions to. Weve been in your shoes - we save you money and time. The most famous are Act 20 and Act 22now the Export Services and the Individual Resident Investor tax incentives respectively under the newly enacted Act 60but.

Learn about Puerto Ricos Advantageous Tax Incentives for businesses Individual Investors Act 22 Export Services Act 20 Film Industry Act 27 More We dont have enough information. 20 of 2012 as amended known as the Export Services Act the Act to offer the. Act 20 was renamed the Puerto Rico Export Services Tax Incentive and became Chapter 3 of Act 60 while Act 22 was now called the Puerto Rico Investor Resident Individual.

An economic development tool based on fiscal responsibility transparency and ease of doing business. Also during the year 2012 two additional laws. Posted in Artículos On Sep 01 2018.

In this episode of El Podcast we talk with Puerto Rican attorney Roberto A. As financial experts we guide you through the process of Act 20 and 22 Tax benefits. The mandatory annual donation to Puerto Rican charity increased from 5000 to 10000.

Puerto Rico Incentives Code 60 for prior Acts 2020. Citizens that become residents of Puerto Rico. Under this new law known as the Incentives Code Acts.

20 of 2012 as amended known as the Export Services Act the Act to offer the necessary elements for the creation of a. Interested in puerto rico tax incentives like act 20 businesses or act 22 individuals.

Puerto Rico Tax Incentives Act 20 22

New Puerto Rico Act 20 22 Tax Incentive Calculator For Businesses And Investors

Act 20 What Service Professionals Need To Know Rsm Puerto Rico

Puerto Rico Tax Incentives Act 20 2012 U S Tax Havens

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Act 20 Act 22 Act 27 Act 73 Puerto Rico Tax Incentives

Why Entrepreneurs Should Move To Puerto Rico Inc Com

Puerto Rico Incentives Code Department Of Economic Development And Commerce

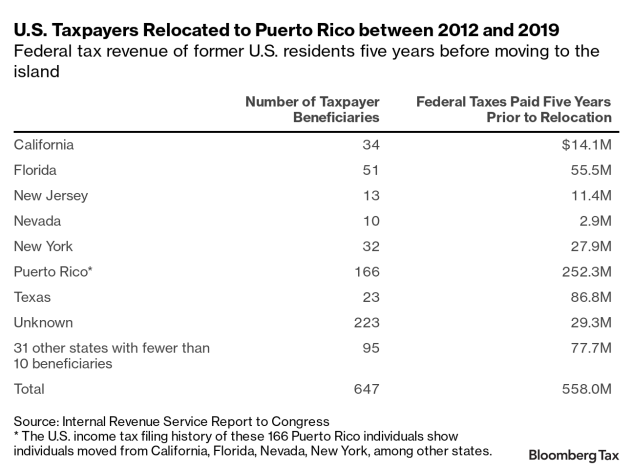

Irs Seizes Foothold On Puerto Rico Tax Haven Audits

Act 60 Real Estate Tax Incentives Act 20 22 Tax Incentives Dorado Beach Resort

Puerto Rico Tax Incentives Guide Puerto Rico Act 20 Act 22 Act 73 And Act 273

Loop Finance Puerto Rico Act 60 Tax Incentives Changing Very Soon Crypto And Stock Investors Need To Apply Asap

Cpi Investigates Puerto Rico Act 22 Tax Incentive Fails News Is My Business

Puerto Rico Tax Law Acts 20 22 Caribbean Luxury Rentals

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Could Statehood End Puerto Rico S Tax Incentives

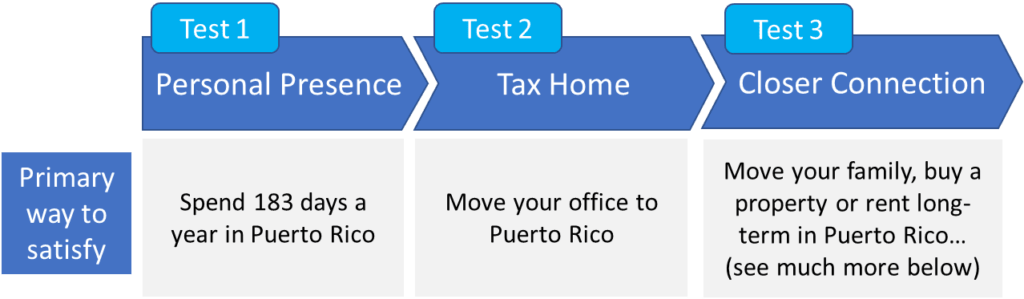

Puerto Rico Tax Incentives Act 20 Act 22 Residency Quickly Learn If The Two Most Popular Tax Incentives In Puerto Rico Are Right For You Why Should I Consider